Remove your Money Blocks and Create New Money Habits in 4-Steps: Part 2

Hi Friends, my name is Lucas and welcome to session 2 of how to break through your financial blocks! If you feel stuck or challenged with money and your not sure what to do about it, you’re in the right place!

In session 1 we identified how and when our financial blocks get created so If you haven’t completed that, check it out now and return when you’re done.

In today’s session we’ll identify the thoughts and habits that hurt us versus the ones that help us So, open up your free workbook from yesterday or download it now and let’s get to it!

In session one, I pointed out that problems with money exist in two places - Internally and Externally - Most people have limited success with money because they focus on fixing the external and completely ignore what’s holding them back internally. - but a sustainable relationship with money requires balance between the two

In today’s session we’ll identify all of the behaviors that are helping us versus the ones that are hurting us. We’ll look at our financial habits (external) and dive much deeper (internal) into our financial thoughts and feelings. Are you ready for a little self reflection?

(If you prefer to watch the video, please check it out here…)

The Help/Hurt List

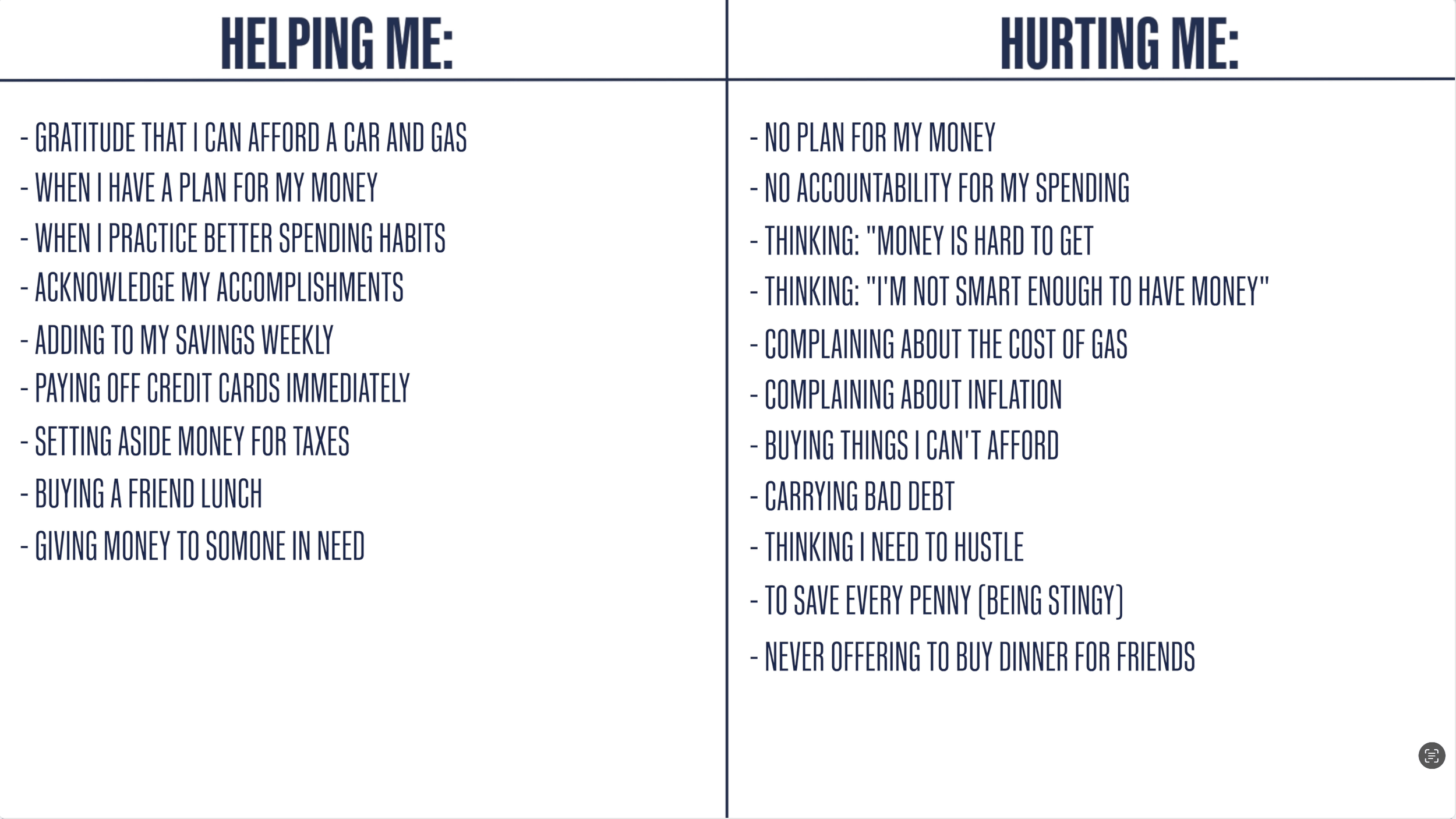

I’d like you to open up your workbook to session 2. You’ll see a page with a line drawn down the center and the words “Helping Me” on the left and “Hurting Me” on the right.

The goal is simple - identify all of the thoughts, feelings and habits that are helping you and hurting you and then right them down. Let me give you several examples.

When I have no plan for my money and no accountability for my spending, these 2 habits keep my bank accounts empty. When I think things like “money is hard to get” or “i’m not smart enough to have it” these thoughts impede my progress.

And when I complain about gas prices or inflation - those feelings of scarcity keep me closed off and stingy. I don’t like how any of that feels, so for me, these behaviors are holding me back and keeping me stuck. Make sense?

Now on the flip side, When I express gratitude for the fact that I can afford I car and gas on a regular basis, I feel so much better and those feelings of lack, completely dissolve.

When I have a plan for my money and learn how to improve my spending, those habits grow my bank accounts. And when i remind myself of the products and services that i’ve created throughout my life, the thought that i’m not smart enough to make money, completely disappears.

Let’s keep going…

Adding to my savings account each week, paying off credit cards immediately, setting aside money for taxes, buying a friend lunch and giving money to someone in need are all things that contribute to my health, wealth and happiness.

Buying things I can’t afford, carrying debt, thinking that I have to hustle all the time or save every penny, never offering to pay for dinner - all of these things take away from my health, wealth and happiness.

If you look closely at the page, you’ll see my list which may spark a few ideas for you and of course, feel free to carry over some of your answers from session 1 if that’s helpful. Write down as many behaviors as you can and then sit with things for a few days.

Some financial blocks are so deep that they’re easy to miss so keep a running list on your phone so that when an old habit or negative self talk kicks in, you can write it down. I’ve been adding to my list for 5 years!

And if you’d like some help adding to your list, schedule a free 1 on 1 session with me. I’d love to hear more about your situation and help you identify your financial blocks as well as all of the places you may be currently leaking money. Comment free call and I’ll send you a link.

Step 2:

Once you have a few things written down, I’d like you to look at the 2 lists.. Are they perfectly balanced or do you spend a lot more energy on one side versus the other?

The first time I did this exercise, I was SHOCKED to see that I had 30 things that were hurting me and only 6 that were helping me. I spent most of my time doing and thinking things that were undermining my financial health and happiness.

Simply put, I was completely out of balance! How about you? Which side of the list have you been putting the majority of your energy?

In the next 2 sessions I’ll show you how to let go of the things that are hurting you but for the rest of the day, I invite you to look over your answers from sessions 1 and 2. What patterns and behaviors do you notice?

The more honest you can be with yourself and the deeper you go, the more financial freedom you’ll experience in the coming sessions.

By the way, I’d love to hear from you. Feel free to share in the comments and subscribe if you found this video helpful. Thanks you for your time and energy, see you in session 3!

Today’s lesson is a tiny fraction of what I share in the Big Split program so if you’d like to transform your finances in 1 week, click here to schedule a free 60 minute call with me.

Lucas Z.