Remove your Money Blocks and Create New Money Habits in 4-Steps: Part 1

Do you feel stuck or blocked with money but you’re not sure why? Join me for this special 4 part series where we’ll identify and break free from our financial blocks

Hi, my name is Lucas and welcome!! When I first started teaching clients how to improve their business and personal finances I quickly realized that it’s not so much the number in our bank account that keeps us stuck but what we think and how we feel about that number.

Over the next 4 sessions we’ll identify the specific behaviors that keep our bank accounts empty. I created a free workbook for your to follow along with. Download it now and rejoin me when you’re ready.

(If you prefer to watch the video, please check it out here…)

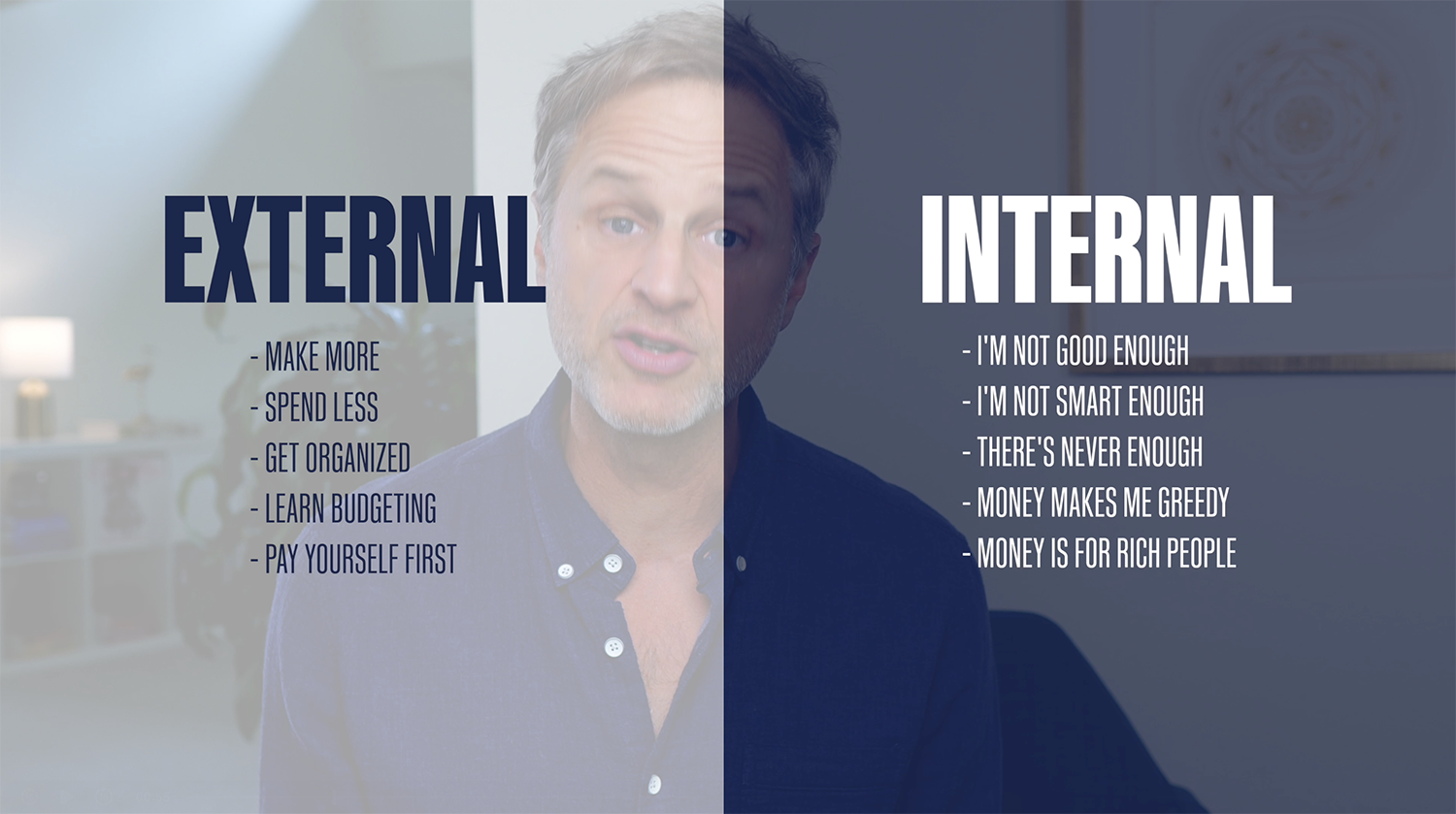

The Internal Vs. The External

In my experience, problems with money exist in two places. There’s the External, which has to do with our income and spending habits and there’s the Internal which has to do with our thoughts and feelings about money.

Most people change their external circumstances and completely overlook what’s going on internally but if you’d like to get un-stuck, The key to is to practice balance between both.

Think of it this way… Imagine working out everyday and putting in the reps and then eating ice cream and candy every night. You may look good on the outside for a little while but internally, you're slowly falling apart.

A Trip Down Memory Lane

From the ages of 0-10 we absorb EVERYTHING that we see, hear and feel. Whether your parents fought about money or had plenty, all of it gets stored in our mind and body.

So, who were you hanging out with from ages 0-10? Mom, Dad, Grandparents, Aunts, Uncles, caregivers, maybe a nanny? In your workbook, please list up to 6 names.

Now, looking back, what kind of relationship did they have with money? If it was great, meaning, they had plenty and were generous, write the word Abundance next to their name. If they struggled, meaning, money was always tight, they were always stressed, write the word Lack next to their name.

What Did You Hear Growing Up?

Must of us have heard the phrase, “Money doesn’t grow on tress” and while it seems harmless enough - The statement implies that money is scarce and hard to get. I don’t know about you but I heard it many times growing up.

Now, I wasn’t thinking about the idea on a regular basis but I had become a workaholic, trying to make as much as I could and I was super stingy, saving all of my money and never letting it go. Why? Because deep down, I believed that money was scarce and hard to get.

Each time we hear something about money, a little seed gets planted. And when we hear it a few more times, the seed grows into a weed. By the time we reach adulthood, our financial garden is full of weeds.

In the last 2 sessions I’ll show you how to pull these weeds and clear your financial garden but for now, I’d like you to get clear on how many weeds you currently have.

Please list all of the ideas and phrases that you heard about money throughout the years. Could be from relatives, friends, co-workers, an ex… Write down everything you can remember.

And by the way, it doesn’t have to be negative. If you have a few helpful ideas floating around, write them down as well.

What Do You Feel With Money?

Our feelings have a massive effect on our financial choices but most of us completely overlook what we’re feeling. In your workbook, I listed several common emotions people have towards money.

I’d like you to circle 6 that you feel on a regular basis. Out of those 6, How many are positive and uplifting and how many are heavy and stressful? Mine were completely skewed towards the stressful

Now think about the people who raised you. Knowing what you know now, do you think they were feeling happy or stressed when it came to money back then? Write the word Happy or Stressed next to their name.

And I’d like to be clear here, I’m not saying that your parents or family members were intentionally teaching you poor financial habits. What I’m saying is that they’re regular people who had their own struggles with money and Because they had great influence over us, we picked up on how they think and feel

Who Do You Spend Your Time With?

They say that, “we are who we hang out with” so, who do you spend most of your time with? Family, friends, a spouse, your children, co-workers, clients.. and If you don’t have many people, who are you spending time with virtually?

Please list the names of 6 people and then ask yourself, what kind of relationship do they have with money? Are they living paycheck to paycheck or are they financially free? Are they constantly complaining about money or do they pick up the tab often?

Write the word Abundance or Lack next to their name and then make an educated guess as whether they feel Happy or Stressed and write that next to their name as well.

Now, take a few minutes to look at your answers. Notice anything interesting? I was shocked to realize that everything I knew about money was borrowed from other people and that most of those people had an awful relationship with it.

As Marty Mcfly would say, “That’s HEAVY”, but on the flip side, now that I can see how and when my financial blocks were formed, I can learn how to let them go and create new financial habits which we will address in the next three sessions.

In Conclusion

I went through things pretty quickly so I invite to go back and sit with each question. Take your time responding. Dig deep. Each answers is a puzzle piece and when you put all of the pieces together, a clear picture of your financial foundation will form.

The more Awareness we bring to our financial past, the better positioned we are to create a new financial future. and if you’re ready to dig even deeper and radically improve your finances in less than a week 1 on 1 with me, let’s hop on a free call. Comment ‘free call” and I’l send you link.

And If today’s session has stirred up a lot of emotions or you’re feeling a bit overwhelmed, you’re not alone. Get outside and move your body…Work out, go for a run, do some yoga - Take a few deep breathes and shake out all of the heaviness.

By the way, I’d love to hear from you. Leave a comment, like or subscribe. And if you know anyone that could benefit from this 4 part series, please pass it along.

Thank you so much for your time and energy. I’ll see you in session 2

Today’s lesson is a tiny fraction of what I share in the Big Split program so if you’d like to transform your finances in 1 week, click here to schedule a free 60 minute call with me.

Lucas Z.