Transform Your Business and Personal Finances at a Deep and Lasting Level

Would you like to improve your business and personal finances at a lasting level? In today’s video, we’ll explore how. Welcome, My name is Lucas and if you’re tired of doing money from a place of frustration and survival, you’re in the right place.

Every person I work with would like to improve their finances. For some, that means paying off $100k of debt, For others, it means building their savings, investments or emergency funds.

Everyone has different goals but

the common thread I see is that we no longer want to worry and stress about money. No more surviving and just getting by.

Thankfully, the world is shifting and the fact that you’re here with me is a sign that you are as well. If you’re ready to simplify your life and have plenty, let’s get into it. (If you prefer to watch the video, please check it out here…)

Three Steps to Improve Your Business and Personal Finances:

Growing up, we never learned the fundamentals of money and had to figure it out for ourselves. On top of that, we absorbed all kinds of limiting beliefs and poor financial habits

So, to improve our finances, we want to:

REMOVE the old foundation - meaning, all of the limiting beliefs and habits that keep us small.

RECOVER from our past choices.

Then CREATE a new experience with money.

Now, the cool thing is, CREATING a strong financial foundation is quite simple. Learn the basics, practice the basics & perfect the basics. Do that and you’ll have plenty. I walk you through that process here.

But, before we can start Creating, we have to address the elephant in the room - All of the thoughts and habits that are keeping us stuck. So. let’s get into it.

Step 1: Remove The Old Financial Foundation

Every problem we have, with money and in life, starts in our mind as a thought. As Peter Crone says,

“The primary cause of unhappiness is never the situation but your thoughts about the situation”

Our thoughts about money, create our problems with money. So the first step to improving our finances is to get clear on all of our limiting beliefs and remove them. For example…

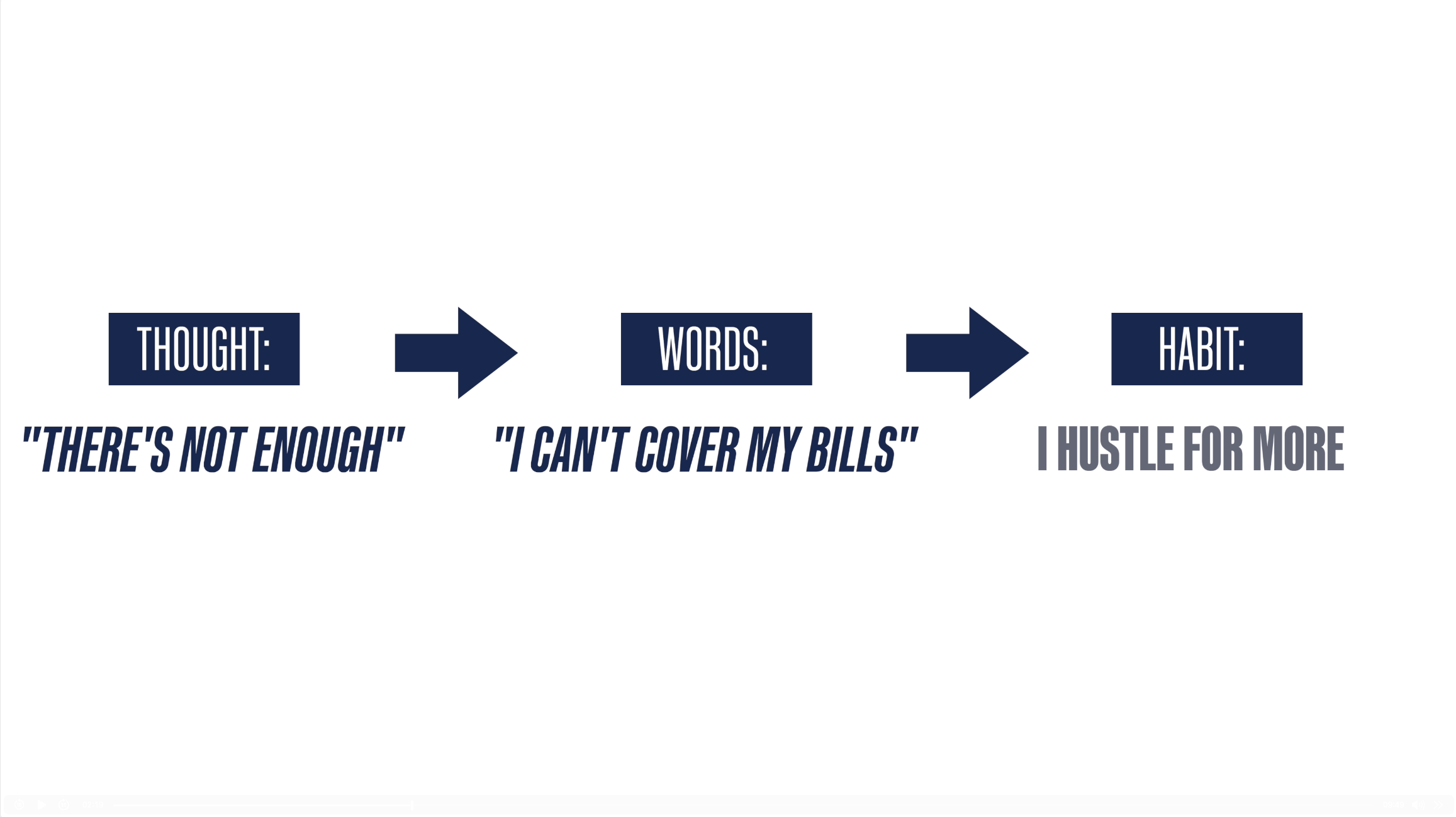

When I think, “there’s not enough”, I say things like “I can’t cover my bills”. Then, I work harder and start hustling. My limiting thought turns into my poor habit.

But, when we debunk our limiting beliefs, our words, actions and habits change. For example: Lot’s of people started with nothing and now have plenty - they would strongly disagree with the idea that “there’s not enough”. The difference is, they choose not to believe the idea.

When I realized this, I stopped subscribing to the idea and recognized that there’s plenty, I no longer say things like “I can’t afford it” and there was no reason for me to hustle.

When we remove our limiting financial beliefs FIRST, there’s a cascading effect. We change our thoughts, we use different words, our actions change and we create new habits.

I spent two decades trying to improve my habits FIRST but made more progress in one month by addressing my financial thoughts. If you’d like to improve your finances at a deep and lasting level, get clear on your limiting financial beliefs and remove them.

Of course, I had the help and guidance of a couple of experts - I started with Ken Honda’s Money EQ course on Mindvalley and went even deeper with Peter Crone’s Financial Freedom Workshop.

After both courses, I felt like a new man - I didn’t stress and worry about money, I was happier, more generous and experienced a level of freedom with my finances I didn’t know was possible.

I’ll leave links to both courses and by the way, I’m not being paid by Ken or Peter. I recommend them because I know what they’ve done for me and I believe they can help you.

Identify and Remove Your Poor Financial Habits

Like pulling a weed out by it’s roots, when you remove your limiting beliefs, your financial problems can no longer grow. And to make sure that you remove all the weeds from your financial garden, you also want to remove your poor financial habits.

For example, chasing clients for money is a poor financial habit. To remove it, implement a policy that guarantees you receive payment BEFORE you start working.

Messy, disorganized and confusing finances is another poor habit that results in lost income. To remove it, simplify your finances and get organized.

I can keep going but hopefully you see what I’m driving at - if you you’d like to improve your finances, remove your limiting beliefs AND your poor financial habits.

I created a special four part series where I walk you through each step of the process so check that out here and let’s move on to step 2.

Step 2: Recover From Your Past Financial Choices

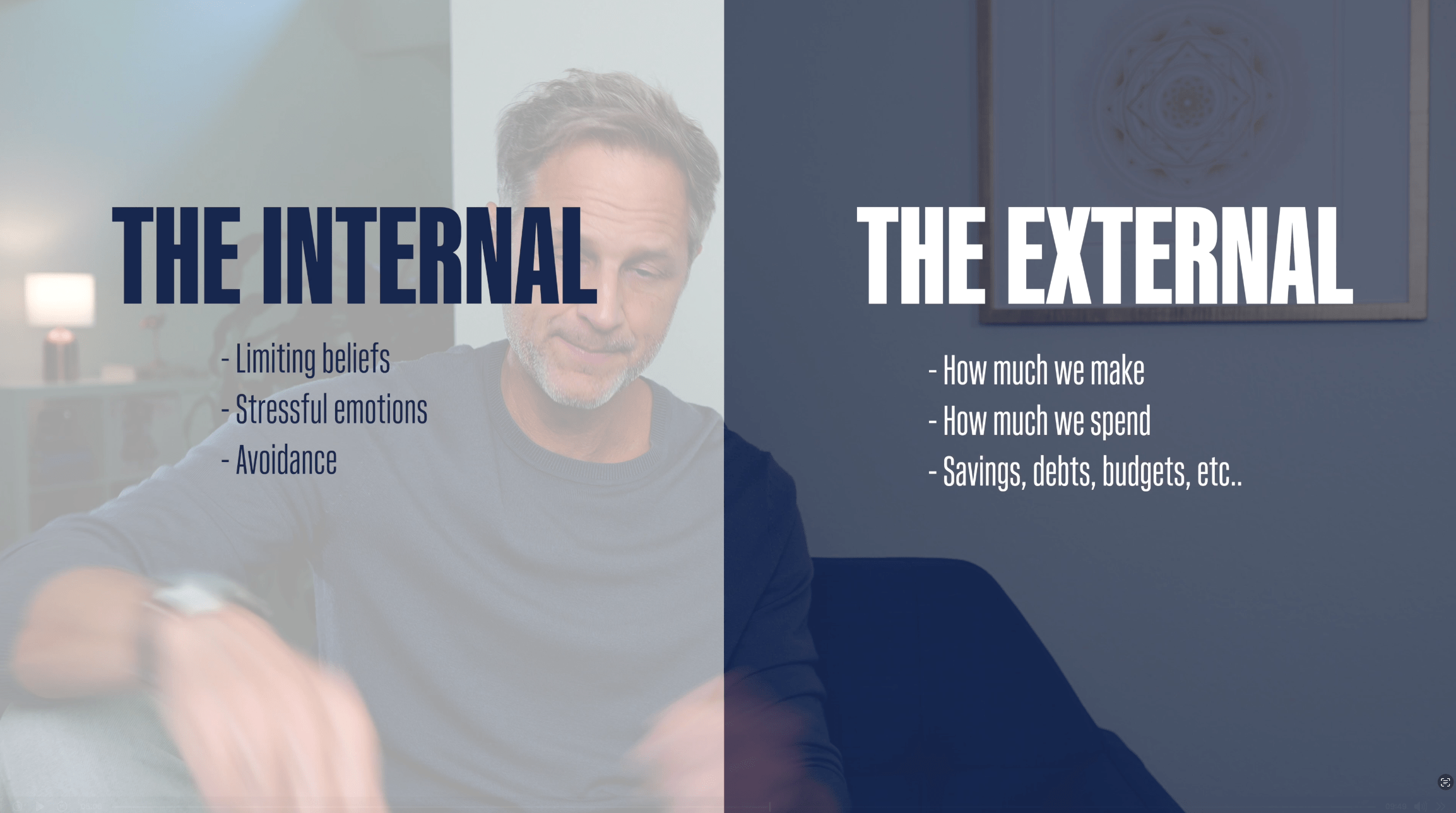

The second step to improving our finances is to Recover from our past financial choices and there’s two levels to this, Externally and Internally.

EXTERNALLY - if you accumulated a lot of debt, from poor financial habits, a simple way to Recover is to create and implement a plan to pay it off.

Most of us have a financial bucket that is full of holes - a simple way to recover from that is to identify and plug your financial leaks. I walk you though that process here and here.

INTERNALLY - Just like we discussed earlier, people tend to overlook or by-pass what’s going on Internally but from my experience, if you’d like to improve your finances at a lasting level, it’s important to address what’s going on inside.

I made a lot of poor choices in my life and because I didn’t know how to process any of it, I shoved it all deep inside. By my late 30’s I had accumulated decades of failures, regrets, shame and guilt and I barely recognized myself.

My hair was falling out, my skin was lifeless and grey, I had bags under my eyes, I was struggling with debilitating anxiety, I was isolated, lonely and extremely unhappy.

But, through the guidance of mentors and a few courses I learned how to process my shame and guilt. Now, I’m not going to lie, it was incredibly uncomfortable to do but I’m so glad that I did because now, I’m free.

And that has had a profound affect on my mindset, my well-being, my happiness - all which result in fantastic finances.

Think of it like this - from the age of, let’s say 12, each time we have an experience in life, from Dad not showing up to your game, to someone bullying you, you accumulate a blanket.

After a couple of decades, you have accumulated thousands of blankets and you’re at the bottom of the pile, suffocating under the weight. But, each time you forgive someone and let go of a grudge, you remove a blanket.

Each time you face a past regret and recognize that you did the best you could and then forgive yourself, you remove several blankets. And when you learn to process your guilt and shame, you remove several thousand blankets.

Your bank accounts are a reflection of what you have going on in your head and what you choose to do with it.

Money reflects back to you what you think about the world and about yourself.

If you would like to improve your finances at a deep, lasting level, improve your relationship to yourself.

I didn’t like my previous choices but I did learn how to Accept them and let them go and I invite you to do the same. The past is the past, you can’t change it but you definitely don’t need to drag it around with you.

So, step two is Recover from your past choices both Externally and Internally.

Step 3: Create a New Experience With Money

Once you’ve removed all of the habits and thoughts that have been limiting you and you’ve learned to Accept your past choices, your ready to create a more Powerful relationship with money.

If you know anyone that has a great relationship with money, take them to lunch and start asking questions. Successful people LOVE to help others create success and if they don’t, that may not be a person you want to learn from.

If you don’t know anyone like that, no worries. It’s easier than ever to get a fantastic financial education. I always recommend starting with the books Rich Dad, Poor Dad and Cashflow Quadrant by Robert Kiyosaki. Both changed my life.

Ken Honda and his book Happy Money and his course Money EQ. Peter Crone and his Financial Freedom Workshop. The book, The Richest Man in Babylon - all good places to start.

But, not all of my Mentors talk about money directly. I learned how to create true success from the Practice of Yoga and Travis Eliot at Inner Dimension TV. I learned how to improve my relationships and my mental, emotional and Spiritual wealth through dozens of courses at Mindvalley.

My point is that once you clear away all that has been keeping you small and limited, an entire new world of Possibility opens up. Get curious and get Educated. Start with my mentors or get busy finding your own.

It’s Time to Create A New Financial Future

Take a moment to think about the path you’ve been on for the last few years or even decades. If you’re tired surviving and just gettin by or maybe you’ve hit a financial wall. I invite you to do a few things…

Identify all of the thoughts, perspectives and habits that are weighing you down and remove them.

Take time to Accept your past choices and then let them go

Once you’re feeling lighter and more free, Get Curious, Get Educated and CREATE a new relationship with money.

In my experience, that is how you improve your finances at a deep and lasting level. And if you’d like some personal guidance, I’d love to learn more about you and your goals. Click here to apply for a free coaching session with me!

I hope you enjoyed today’s video. If you have any questions or something you’d like to share, please leave a comment. And If you know anyone that could benefit from this, please share it with them.

Thank you so much for your time and energy and thank you for choosing to show up for you!

- Lucas Z.